Health insurance: call to action

Precision medicine is an advantage for customers and insurers.

A CEO-level case to lead, not lag.

Partner with Genomic Vault. Offer secure access that benefits customers and portfolios. Privacy preserved. Shape the transition.

1. The Problem

Genomics is mainstream. Sequencing costs have fallen from ~USD 10M in 2007 to <USD 500 today. National programmes like UK Biobank and the 100,000 Genomes Project have normalised testing in healthcare. Direct-to-consumer genomics is widespread: Swiss Re data shows that by 2022, 21% of US adults had already taken a genetic test at home.

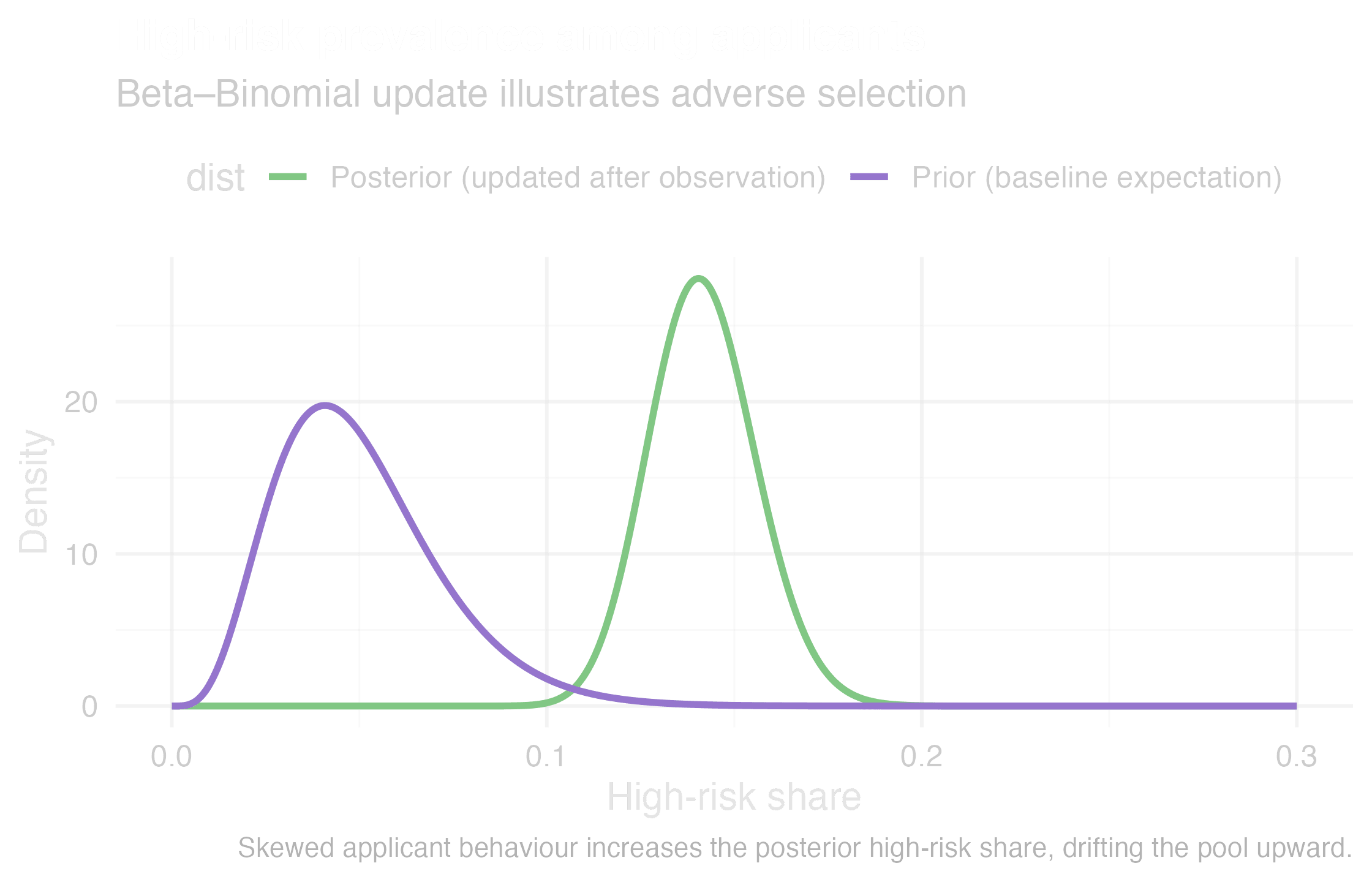

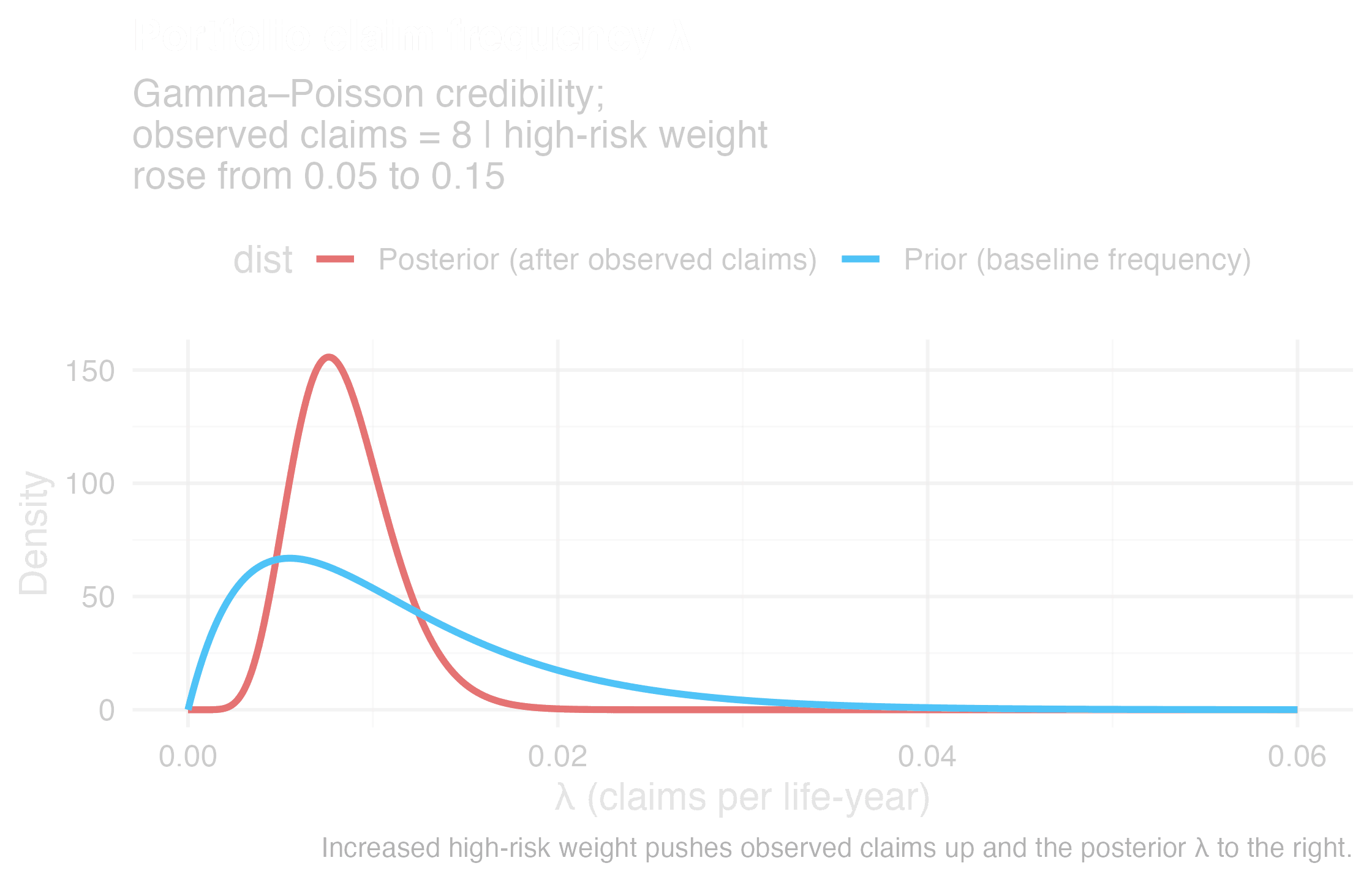

The insurance impact is measurable. Anti-selection occurs when customers know more about their own health risks than you do. For instance, Swiss Re’s 2024 research report shows people with high-risk genetic findings are 2–4× more likely to buy Life insurance and 2–5× more likely to buy Critical Illness (CI). Canadian actuarial studies show that without predictive data, Life claims increase 12% and CI claims 26%. Low-risk lives leave, high-risk lives stay, and the pool drifts against you. This is not theory. It is already visible.

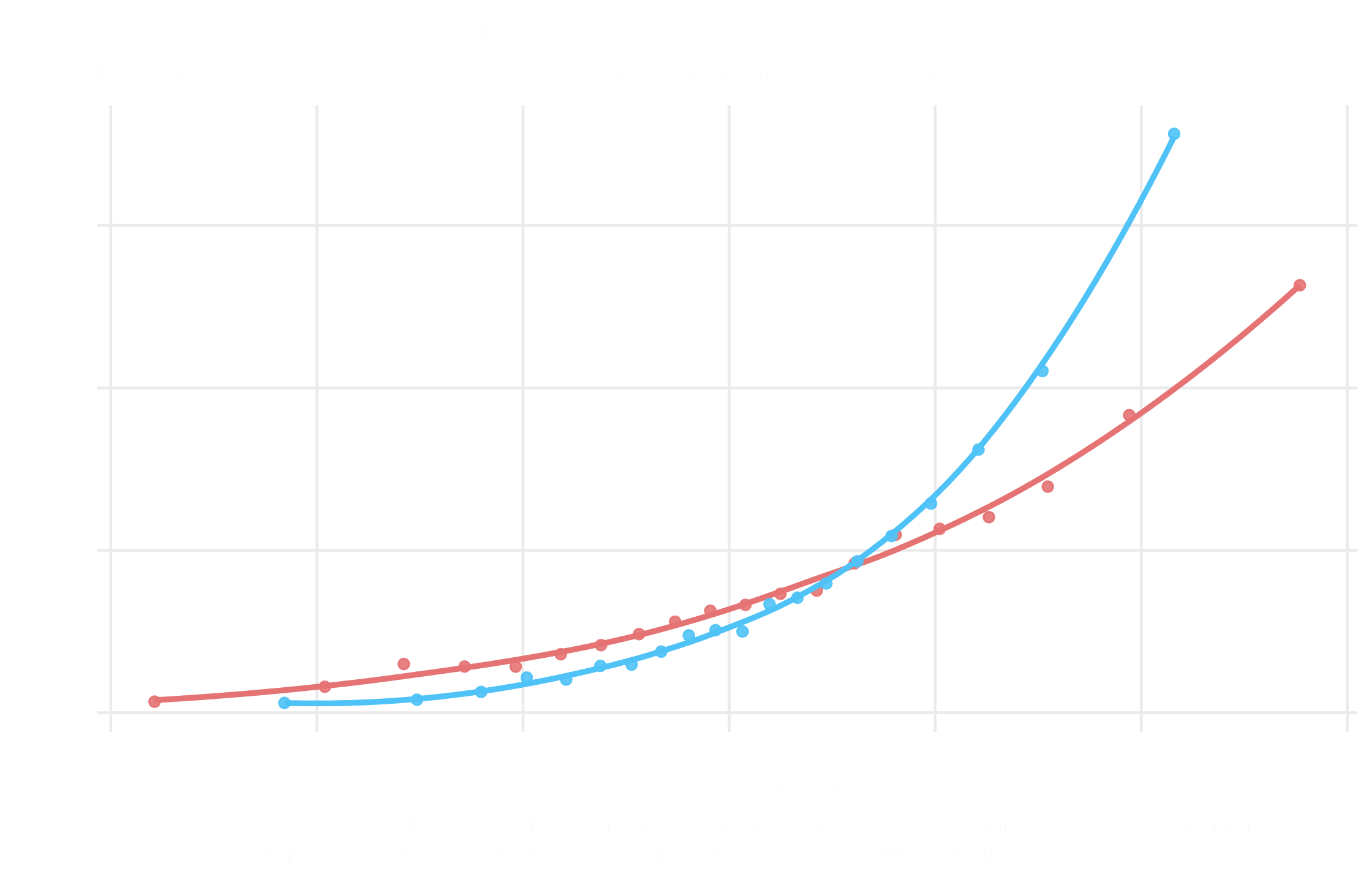

Adverse selection shifts the risk pool

Claim frequency drift under information asymmetry

2. The Weak Response

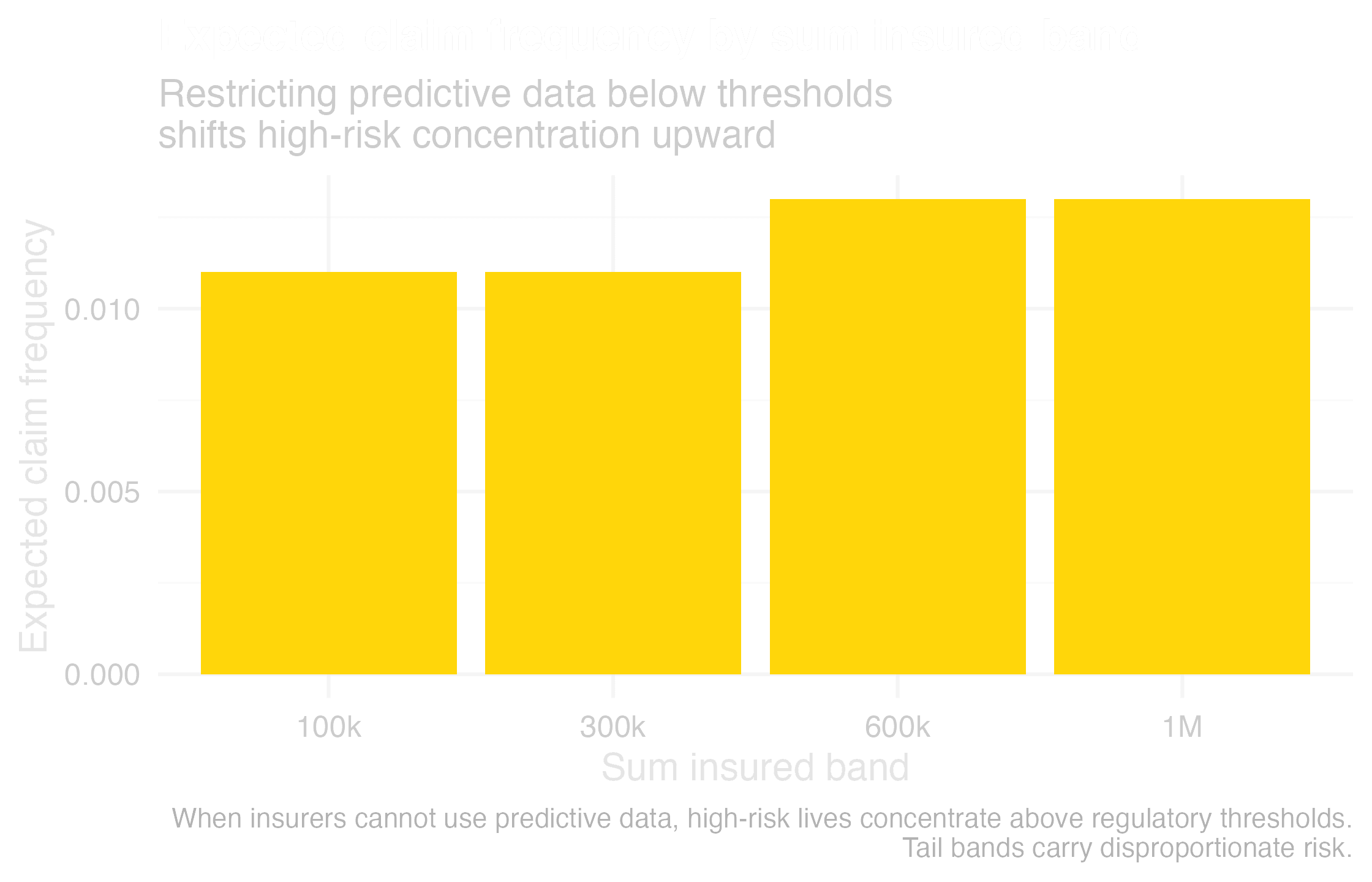

The current fallback is family history as a proxy for inherited genetic risk (what geneticists calculate with identity by decent or sequence). Regulators tolerate it today, but it is fragile. Family history is noisier than polygenic scores or clinical genomics. It is effectively an indirect genetic test, and once regulators call it out, the practice will collapse. Basing long-term models on this proxy is burying your head in the sand.

Threshold regulation concentrates risk in the tail

Family history is a weak, noisy proxy vs genomic risk score

3. The Solution

Swiss Re, for instance, reports that genomics improves morbidity and mortality outcomes. The evidence is clear: identifying BRCA cancers or familial hypercholesterolaemia early prevents catastrophic claims. Pharmacogenomics avoids costly drug failures. Multi-cancer early detection smooths portfolios. These are stabilisers, not expenses.

The durable solution is to channel genomics into care, not underwriting. Subsidise secure, clinical-grade infrastructure so customers and physicians can act on results. Insurers never see raw genomes, staying fully compliant and reputation-safe. The payoff is earlier interventions, fewer black swan events, and sustainable Life and CI books.

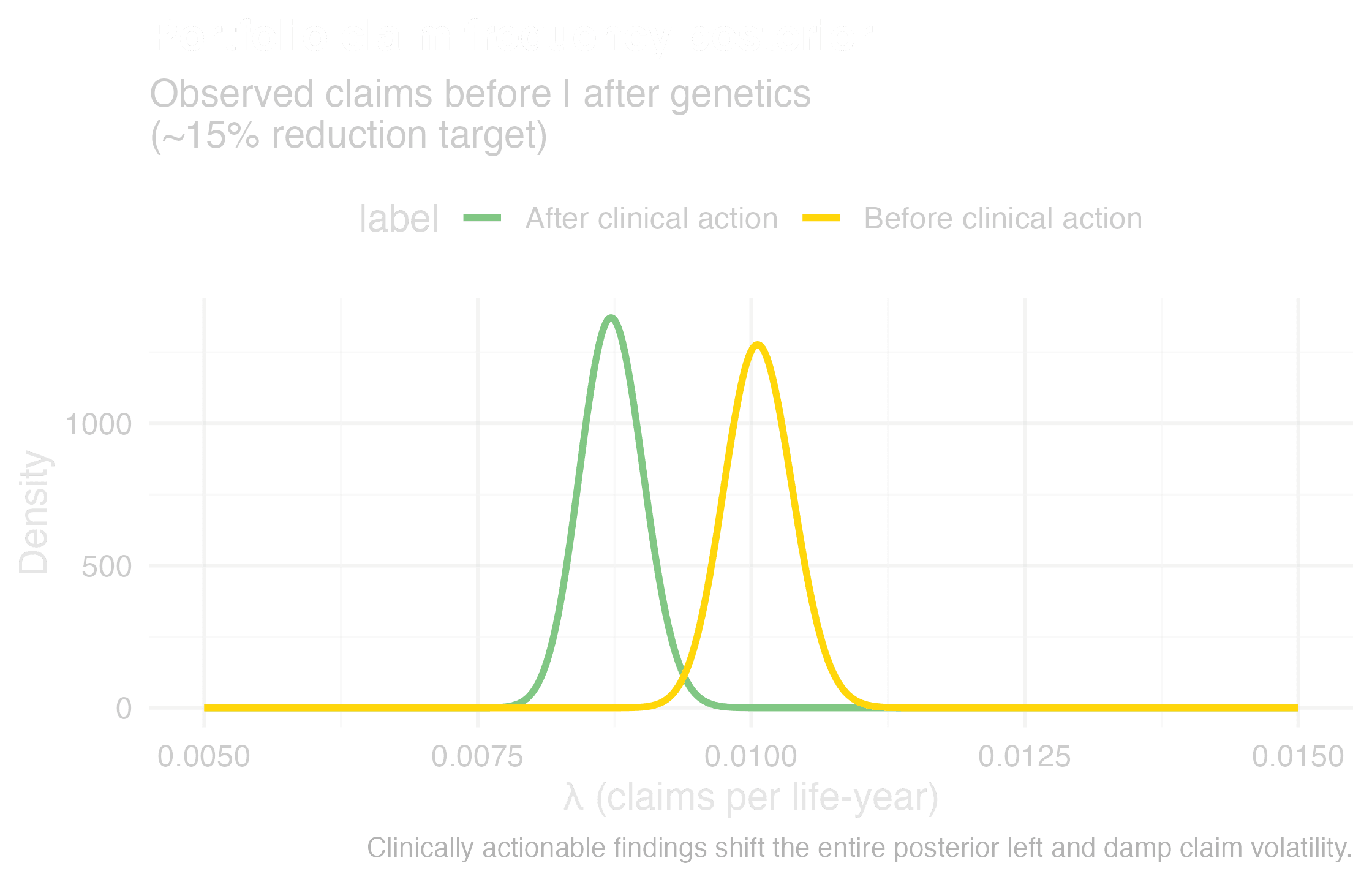

Actionability reduces claim volatility